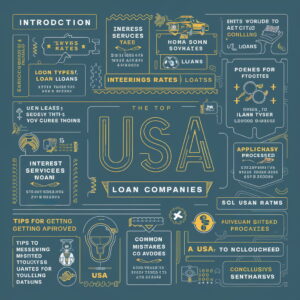

Introduction

Importance of choosing the right loan company

Overview of the lending landscape in the USA

Criteria for evaluating loan companies

Types of Loans Available

Personal loans

Business loans

Student loans

Mortgage loans

Payday loans

Key Criteria for Evaluating Loan Companies

Interest rates and fees

Loan terms and flexibility

Customer service and support

Application process and approval time

Reputation and customer reviews

Top Loan Companies in the USA

Overview of the top companies reviewed

Brief mention of their standout features

SoFi

Overview

Types of loans offered

Interest rates and terms

Customer reviews and ratings

Pros and cons

LendingClub

Overview

Types of loans offered

Interest rates and terms

Customer reviews and ratings

Pros and cons

Avant

Overview

Types of loans offered

Interest rates and terms

Customer reviews and ratings

Pros and cons

Upstart

Overview

Types of loans offered

Interest rates and terms

Customer reviews and ratings

Pros and cons

Prosper

Overview

Types of loans offered

Interest rates and terms

Customer reviews and ratings

Pros and cons

Marcus by Goldman Sachs

Overview

Types of loans offered

Interest rates and terms

Customer reviews and ratings

Pros and cons

Best Egg

Overview

Types of loans offered

Interest rates and terms

Customer reviews and ratings

Pros and cons

Discover Personal Loans

Overview

Types of loans offered

Interest rates and terms

Customer reviews and ratings

Pros and cons

Earnest

Overview

Types of loans offered

Interest rates and terms

Customer reviews and ratings

Pros and cons

Rocket Loans

Overview

Types of loans offered

Interest rates and terms

Customer reviews and ratings

Pros and cons

Conclusion

Summary of the top loan companies and their strengths

Final thoughts on choosing the right loan company

FAQs

How do I choose the best loan company for my needs?

What should I look for in customer reviews of loan companies?

Are online loan companies reliable?

What are the risks of taking out a loan online?

How can I improve my chances of getting approved for a loan?

USA Loan Company Reviews

Introduction

When it comes to securing a loan, choosing the right company can make a significant difference in your financial journey. With numerous options available, it’s crucial to select a lender that offers favorable terms, excellent customer service, and a reliable track record. In this comprehensive review, we will explore some of the top loan companies in the USA, examining their offerings, customer reviews, and what sets them apart from the competition.

Types of Loans Available

Personal Loans

Personal loans are versatile, unsecured loans that can be used for a variety of purposes, such as debt consolidation, home improvement, or unexpected expenses. They typically offer fixed interest rates and terms.

Business Loans

Business loans provide funding for small to medium-sized enterprises (SMEs) for purposes like expansion, equipment purchase, or operational costs. These loans can be secured or unsecured, depending on the lender’s policies.

Student Loans

Student loans help cover the costs of higher education, including tuition, books, and living expenses. They can be obtained from federal programs or private lenders.

Mortgage Loans

Mortgage loans are used to purchase or refinance a home. These loans typically require extensive documentation and have longer approval times, but they offer competitive rates and terms.

Payday Loans

Payday loans are short-term, high-interest loans designed to cover immediate expenses until your next paycheck. They are easy to obtain but often come with higher fees and interest rates.

Key Criteria for Evaluating Loan Companies

Interest Rates and Fees

The interest rate and associated fees can significantly impact the total cost of the loan. It’s essential to compare these factors across different lenders.

Loan Terms and Flexibility

Consider the loan terms, such as repayment period, and the flexibility offered by the lender, including options for early repayment or deferment.

Customer Service and Support

Quality customer service can make the borrowing process smoother and more manageable. Look for companies with positive customer support reviews.

Application Process and Approval Time

A straightforward application process and quick approval time are crucial, especially if you need funds urgently.

Reputation and Customer Reviews

Check the lender’s reputation and customer reviews to gauge their reliability and customer satisfaction.

Top Loan Companies in the USA

In this section, we review some of the top loan companies in the USA, highlighting their features, customer reviews, and pros and cons.

SoFi

Overview: SoFi is renowned for its competitive rates and diverse financial products, including personal loans, student loan refinancing, mortgages, and business loans.

Types of Loans Offered: Personal loans, student loan refinancing, mortgages, business loans.

Interest Rates and Terms: SoFi offers some of the lowest rates in the industry, with flexible repayment terms and no fees.

Customer Reviews and Ratings: SoFi has high customer satisfaction ratings, particularly for its customer service and seamless application process.

Pros and Cons:

Pros: Low-interest rates, no fees, unemployment protection.

Cons: Requires a high credit score, limited to specific loan types.

LendingClub

Overview: LendingClub is a peer-to-peer lending platform that connects borrowers with investors, offering personal and business loans.

Types of Loans Offered: Personal loans, business loans, auto refinancing.

Interest Rates and Terms: Competitive rates with flexible loan amounts and terms. Origination fees apply.

Customer Reviews and Ratings: Generally positive reviews, though some customers note higher rates for lower credit scores.

Pros and Cons:

Pros: Flexible loan amounts, competitive rates, quick funding.

Cons: Origination fees, higher rates for lower credit scores.

Avant

Overview: Avant specializes in personal loans for borrowers with average to good credit scores.

Types of Loans Offered: Personal loans.

Interest Rates and Terms: Higher interest rates compared to some competitors, but offers flexible repayment terms.

Customer Reviews and Ratings: Positive reviews for quick approval and customer service, though some mention high fees.

Pros and Cons:

Pros: Quick approval, flexible repayment terms.

Cons: Higher interest rates, administrative fees.

Upstart

Overview: Upstart uses artificial intelligence to assess loan applications, considering factors beyond just credit scores.

Types of Loans Offered: Personal loans.

Interest Rates and Terms: Inclusive eligibility criteria with competitive rates and fast funding. Origination fees apply.

Customer Reviews and Ratings: High satisfaction for its inclusive approach and quick funding, but some mention high rates for low credit scores.

Pros and Cons:

Pros: Inclusive eligibility criteria, fast funding.

Cons: Origination fees, high rates for low credit scores.

Prosper

Overview: Prosper is a peer-to-peer lending platform offering personal loans.

Types of Loans Offered: Personal loans.

Interest Rates and Terms: Competitive rates with no prepayment penalties. Origination fees apply.

Customer Reviews and Ratings: Generally positive, though some customers experience longer funding times.

Pros and Cons:

Pros: Competitive rates, no prepayment penalties.

Cons: Origination fees, longer funding times.

Marcus by Goldman Sachs

Overview: Marcus offers no-fee personal loans with flexible terms.

Types of Loans Offered: Personal loans.

Interest Rates and Terms: Fixed rates with flexible payment options and no fees.

Customer Reviews and Ratings: Highly rated for its straightforward approach and excellent customer service.

Pros and Cons:

Pros: No fees, fixed rates, flexible payment options.

Cons: High credit score requirement, limited to personal loans.

Best Egg

Overview: Best Egg provides personal loans with competitive rates and fast funding.

Types of Loans Offered: Personal loans.

Interest Rates and Terms: Quick approval with low rates for good credit. Origination fees apply.

Customer Reviews and Ratings: Positive reviews for quick processing and customer support, but higher rates for lower credit scores.

Pros and Cons:

Pros: Quick approval, low rates for good credit.

Cons: Origination fees, higher rates for lower credit scores.

Discover Personal Loans

Overview: Discover offers personal loans with flexible repayment options and no fees.

Types of Loans Offered: Personal loans.

Interest Rates and Terms: Fixed rates with flexible terms and no fees.

Customer Reviews and Ratings: Generally positive, with praise for the no-fee structure and good customer service.

Pros and Cons:

Pros: No fees, fixed rates, flexible terms.

Cons: Requires good credit, limited to personal loans.

Earnest

Overview: Earnest offers personal loans and student loan refinancing with customizable terms.

Types of Loans Offered: Personal loans, student loan refinancing.

Interest Rates and Terms: Low rates with no fees and flexible terms. Longer approval times.

Customer Reviews and Ratings: Positive reviews

AIPRM – ChatGPT Prompts

Favorites

AIPRM

Public

Own

Hidden

Add List

Topic

Activity

Sort by

Model

Warrant attorney local page 1

Marketing / Marketing

·

Olya Lytvyn

·

5 months ago

Article Writer GPT Choose a location and generate a perfect paragraph for the webpage

484

175

3

Add Public Prompt